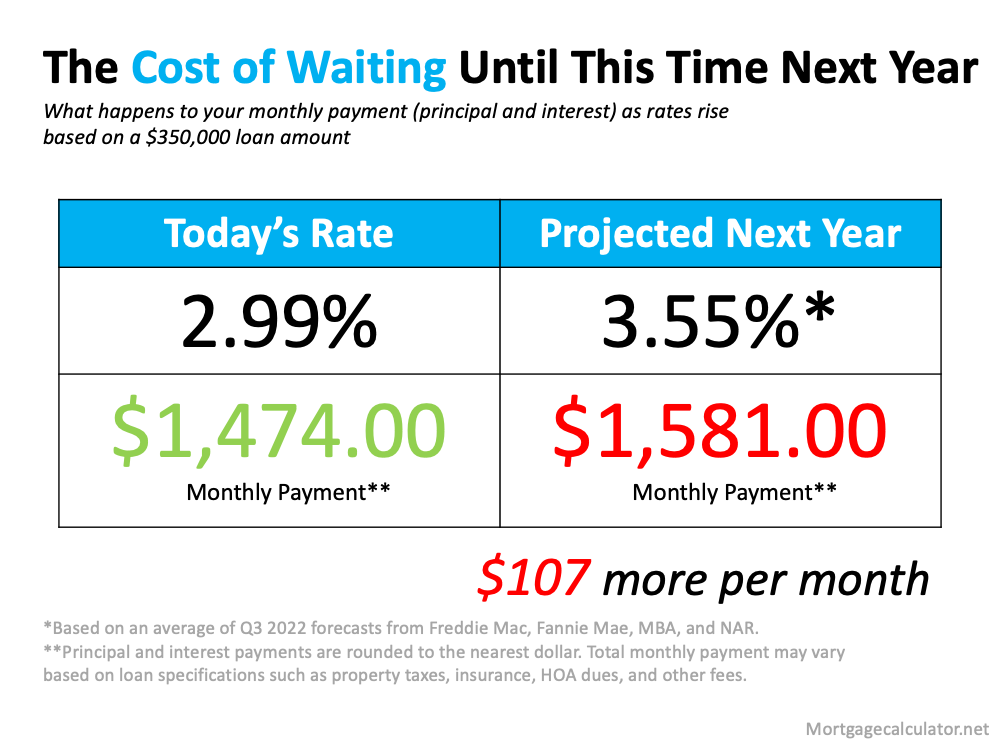

So far this year, mortgage rates continue to hover around 3%, encouraging many hopeful homebuyers to enter the housing market. However, there’s a good chance rates will increase later this year and going into 2022, ultimately making it more expensive to borrow money for a home loan. Here’s a look at what several experts have to say.

Danielle Hale, Chief Economist, realtor.com:

“Our long-term view for mortgage rates in 2021 is higher. As the economic outlook strengthens, thanks to progress against coronavirus and vaccines plus a dose of stimulus from the government, this pushes up expectations for economic growth . . . .”

Lawrence Yun, Chief Economist, National Association of Realtors (NAR):

“In 2021, I think rates will be similar or modestly higher . . . mortgage rates will continue to be historically favorable.”

Freddie Mac:

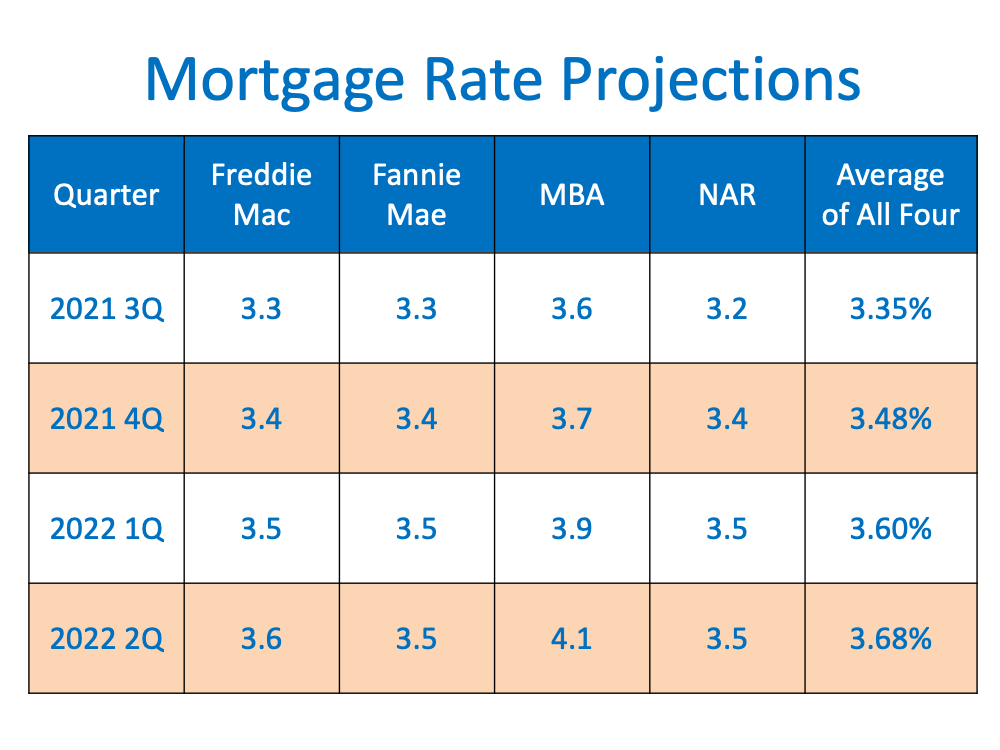

“We forecast that mortgage rates will continue to rise through the end of next year. We estimate the 30-year fixed mortgage rate will average 3.4% in the fourth quarter of 2021, rising to 3.8% in the fourth quarter of 2022.”

Below are the most recent mortgage rate forecasts from four top authorities – Freddie Mac, Fannie Mae, the Mortgage Bankers Association (MBA), and NAR:

Bottom Line

If you’re planning to buy a home, purchasing before mortgage interest rates rise may help you save significantly over the life of your home loan.

Share This Story, Choose Your Platform!

About the Author

David Carroll

I will deliver quality information to you to make the most informed decision on your purchase and will work hard to execute a successful and smooth transaction. Once you’re ready to tour homes, I have the expertise and resources to help you achieve all your Real Estate goals. How may I help you?